The payment procedure for acquiring property is often as crucial as the investment itself. A well-detailed payment method can be the differentiator between a cumbersome buying process and a streamlined one. Among developers in Gurgaon and Noida, M3M has not only established a name for itself for dealing in premium real estate, but also for payment flexibility that meets the needs of varied purchasers. The purpose of this article is to explain the M3M payment plan, its pros, and its growing popularity among residential and commercial buyers.

Understanding the M3M Payment Plan

The M3M payment plan simplifies the real estate buying journey by dividing the total payable amount into scheduled installments instead of demanding a lump-sum payment. These installments are usually linked to construction milestones, possession timelines, or predefined periods.

By slicing the cost into manageable portions, M3M transforms what is typically a large financial commitment into a structured and predictable investment, helping buyers plan cash flow efficiently.

Each M3M project, whether residential or commercial, offers a tailored payment structure aligned with its development stage, protecting buyers from unnecessary financial stress.

Typical M3M Payment Structures

Though M3M has various schemes, advertising a mix of residential and commercial spaces, most of their payment plans are simplified and follow a distinct flow.

Residential Projects – 30:70 Plan or 30:40:30 Plan

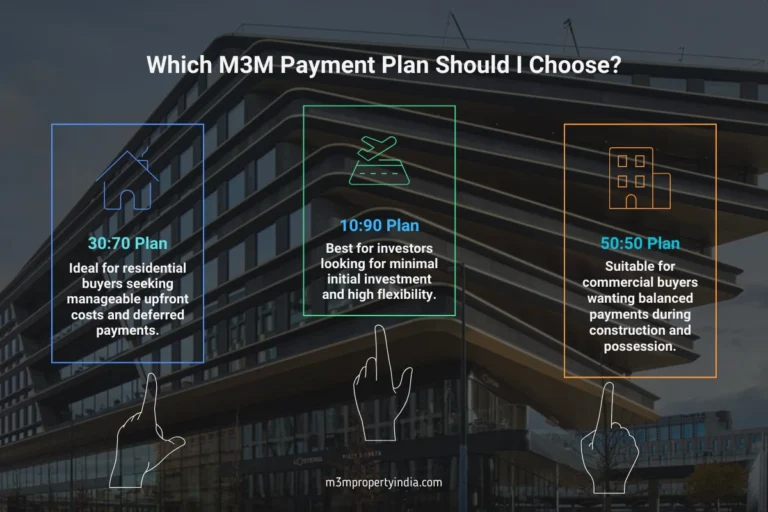

For M3M residential properties, the 30:70 and 30:40:30 payment plans are the most utilized options. Under the 30:70 plan, buyers pay 30% during the construction phase, with the remaining 70% payable at possession, making it especially suitable for end-users seeking minimal upfront outflow and improved cash-flow management.

The 30:40:30 plan offers a more balanced payment structure, where 30% is paid at booking, 40% during the core construction phase, and the final 30% at possession. This plan provides a middle ground between heavy upfront payments and highly deferred schemes, appealing to buyers who prefer a structured yet flexible payment timeline.

Additional Flexible Residential Plans

Beyond the standard options, M3M also offers staggered payment structures designed for salaried professionals and recurring investors:

25:25:25:25 Plan:

The total property cost is divided into four equal parts of 25%, typically linked to major construction milestones such as booking, super structure completion, finishing, and possession. This ensures buyers never pay more than one-quarter of the value at any single stage.

20:20:20:20:20 Plan:

This five-step staggered plan splits payments into equal 20% installments. It is the most diluted structure available and is ideal for buyers planning payments around annual bonuses or long-term savings cycles.

Special Subvention Plans for Residential Projects

In select luxury developments, M3M offers alternative payment structures, including the 10:90 plan and the 15:85 subvention plan, typically introduced for limited periods. Under the 10:90 plan, buyers pay 10% at booking, with the remaining 90% payable at possession, making it an attractive option for investors seeking maximum leverage with minimal upfront capital.

The 15:85 Subvention Plan is occasionally available for specific luxury projects to minimize upfront capital. In this model, the buyer pays just 15% upfront, while the remaining 85% is financed through a bank loan with the developer bearing the pre-EMI interest until possession. Currently, this “light-entry” option is limited to select inventory; for instance, the M3M Forestia West payment plan features this 15:85 structure alongside other standard options.

Note on the “M3M Don’t Pay Plan” (P4) You may have seen advertisements for a 20:80 structure known as the “M3M Don’t Pay Plan” (or P4: Pehle Possession Phir Payment). This specific subvention campaign was highly popular last year for projects like M3M Mansion, but is no longer active.

Commercial Projects – 50:50 or 25:25:25:25 Plan

For M3M commercial properties, the 50:50 and 25:25:25:25 payment plans are commonly offered. Under the 50:50 plan, buyers pay 50% during the construction phase, with the remaining 50% payable at possession. This structure provides a balance of investment security and financial comfort, making it a preferred choice among business owners and commercial investors.

The 25:25:25:25 plan divides the total investment into four equal installments, linked to key construction milestones. For commercial buyers, this plan is often considered superior to the 50:50 model, as it preserves liquidity. Instead of blocking a large portion of capital upfront, investors can retain funds for business operations while the property is under development.

Types of M3M Payment Plans

Though M3M primarily works with the 30:70, 10:90, and 50:50 models, these payment plans are usually tailored in other ways based on the project and buyer needs. Some common ones are:

- Construction-Linked Plan: Payments are made after certain construction milestones like the foundation, floor slab, and finishing work. Buyers are able to make smaller payments while work is being done.

- Possession-Linked Plan: A smaller percentage is paid, such as 10% or 30% and the bulk amount is settled only at the time of possession.

- Time-Linked Plan: Payments are set at specific intervals, such as monthly or quarterly, irrespective of construction progress.

- Hybrid Payment Plan: M3M occasionally introduces a mix of the above structures to balance investment liquidity and project security. A prime example is the M3M Elie Saab Payment Plan, which uses a unique 25:30:35:10 structure. This hybrid model combines time-based initial payments with construction-based milestones later in the cycle, ensuring capital efficiency for the investor.

This ensures every buyer, whether an end-user or an investor, is able to find a structure that works within their comfort zone.

For specialized details and for the particular M3M payment schedule that corresponds to the property you are interested in, do call us for a custom consultation.

Benefits of Flexible M3M Payment Plans

One of the standout features of the M3M payment plan is its convenience. Instead of being stuck to a certain format, M3M offers flexible payment options catering to diverse financial requirements.

- Balances buyers’ financial burden: Instead of needing to pay a big amount during the initial stage, buyers are able to pay through an installment plan.

- Clarity and Assured Payment System: Constructive stages linked to payments are tracked, ensuring that construction milestones are not missed.

- Investor Friendly: Deferred payment options such as 10:90 and 15:85 allow investors to leverage capital efficiently.

- Ease of the Final Consumer: 30:70 models are commonplace and serve to help the genuine homeowner budget until the time of ownership transfer.

The construction and flexibility approach which blends structure and adaptability, adds to the M3M approach in Gurgaon and Noida’s commercial property landscape.

How M3M Payment Plans Compare with Market Norms

In real estate, the payment methods used by competing developers often vary the most. Traditional builders, for instance, often stick to outdated and inflexible methods like burdening clients with steep upfront payments or paying according to a progress-linked timetable. In contrast, the M3M’s buyer-first approach focuses on staged, milestone-based payments, significantly reducing financial strain.

Residential buyers benefit from deferred models like 30:70, while investors gain leverage through 10:90 or 15:85 schemes. On the commercial side, options like 25:25:25:25 offer superior liquidity management. This flexibility is a key reason why M3M properties are seen as premium yet financially accessible.

Why Buyers Benefit From the M3M Payment Plan

The purchasing journey in real estate is often marked by the ease in meeting the financial responsibilities. The M3M payment plan’s structured and flexible options stand out as key reasons why many developers are focusing on end-users and investors in Gurgaon and Noida. M3M’s 30:70, 10:90, and 50:50 payment structures help ease the financial burden that comes with buying premium real estate.

In the NCR, luxury and commercial property buyers need to find the right deal. The M3M payment plan gives them the freedom to make their own well-informed decisions.

Critical Advisory: Understanding the “EMI Trap”

While subvention schemes where the developer pays your pre-EMI interest are appealing, recent market analyses, including reports highlighted by the Times of India warn that such “easy buy” schemes can carry risks if not managed carefully.

The Risks You Must Know

- The Loan Is Yours: Even if the builder promises to pay the interest, the loan is legally in your name. If the developer defaults, the bank will demand EMIs from you.

- Credit Score Impact: Any missed payment, regardless of who was supposed to pay, can negatively affect your CIBIL score.

- The Double Whammy: In cases of project delay combined with payment default, buyers may end up paying both rent and EMI simultaneously.

How to Stay Safe

Always ensure the project is RERA registered and insist on a clear Tripartite Agreement involving the buyer, builder, and bank that clearly defines responsibilities. For maximum safety, prioritize Construction Linked Plans where payments are released only after actual progress is completed on the ground.

M3M Payment Plans: FAQs

Q1. What is the standard M3M payment plan for residential properties?

Most M3M residential projects follow the 30:70 structure, where 30 percent of the property value is paid during the construction phase and the remaining 70 percent is payable at the time of possession. This plan is widely preferred by end users for balanced cash flow planning.

Q2. Does M3M offer flexible options beyond 30:70?

Yes. Beyond the 30:70 plan, M3M offers multiple flexible payment options depending on the project and launch phase. These include 10:90 and 15:85 subvention plans for select luxury developments, along with staggered structures such as 25:25:25:25, 20:20:20:20:20, and 30:40:30 designed for salaried professionals and long term investors.

Q3. What is the common payment structure for M3M commercial projects?

M3M commercial projects typically operate on a 50:50 payment plan, where 50 percent is paid during construction and the remaining 50 percent at possession. In select projects, a 25:25:25:25 structure is also available, allowing investors to spread payments evenly while maintaining business liquidity.

Q4. Are these M3M payment plans RERA compliant?

Yes. All M3M payment plans are structured in compliance with RERA guidelines. Payments are linked to construction milestones or clearly defined stages, ensuring transparency and protecting buyer interests. Buyers should always verify the project RERA registration before proceeding.

Q5. Which M3M payment plan is best for end users vs investors?

End users generally prefer the 30:70 or staggered residential payment structures such as 25:25:25:25 for easier financial planning. Investors often opt for leverage driven options like the 10:90 or 15:85 subvention plans, or liquidity friendly commercial plans depending on their investment goals and risk appetite.